springfield mo sales tax rate 2020

Fast Easy Tax Solutions. State Local Sales Tax Rates As of January 1 2020.

/cloudfront-us-east-1.images.arcpublishing.com/gray/52PQVHDQV5AADCIUFDSB2QMP4Q.jpg)

Hickory County Looking To Impose A 911 Sales Tax Causes Confusion With Residents

Section 144014 RSMo provides a reduced tax rate for certain food sales.

. There will be an eight percent sales tax rate in Springfield Missouri in 2022Total state county and city sales tax rates are included in this tableSince 2004. This is the total of state county and city sales tax rates. Updated November 2019.

The Springfield sales tax rate is. 15 lower than the maximum sales tax in MO. The County sales tax rate is.

Springfield MO Sales Tax Rate. 2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes.

Rates include state county and city taxes. January February March 2020 Updated 01092020 Taxation Division Sales and Use Tax Rate Tables Missouri Department of Revenue Run Date. Indicates required field.

Did South Dakota v. The latest sales tax rates for cities in Missouri MO state. Springfield mo sales tax rate 2020 Saturday March 12 2022 Edit.

The rate for food sales was reduced by 3 from 4225 to 1225. There is no applicable special tax. 417-864-1000 Email Us Emergency Numbers.

University City MO Sales Tax Rate. Tax Holiday Rate Tables - 080522 - 080722 - PDF. Cities and counties may impose a local sales and use tax.

What is the sales tax rate in the City of Springfield. The minimum combined 2022 sales tax rate for Springfield Missouri is. Special taxing districts such as fire districts may.

The table below shows sales tax rates for all the counties and the largest cities in Missouri. 2020 rates included for use while preparing your income tax deduction. Average Sales Tax With Local.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Raised from 6225 to 8725 Meadville Linneus Wheeling Sumner Purdin and Chula. Raised from 66 to 7725.

You pay tax on the sale price of the unit less any trade-in or rebate. CAM-MO AMBULANCE DISTRICT GREENVIEW CID. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355.

1 is collected for. Statewide salesuse tax rates for the period beginning January 2020. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Wentzville MO Sales Tax Rate. Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax. Find Sales and Use Tax Rates.

The latest sales tax rate for Cassville MO. There are a total of 741 local tax jurisdictions across. For other states see our list of nationwide sales tax rate changes.

City of Springfield Tax Rates. Ad Find Out Sales Tax Rates For Free. Missouri has a lower state.

Change Date Tax Jurisdiction Sales Tax Change Cities Affected. Higher sales tax than 62 of Missouri localities. Wednesday July 01.

Enter your street address and city or zip code to view the sales and use tax rate information for your address. KY3 - The city of Springfield says its latest sales tax check is more than 1 million over budget. There is no applicable special tax.

The 3 reduction applies to all types of food items that may be purchased with Food Stamps click here for more information on eligible food items This includes food or food products for home consumption. 102020 - 122020 - XLS. 012020 - 032020 - PDF.

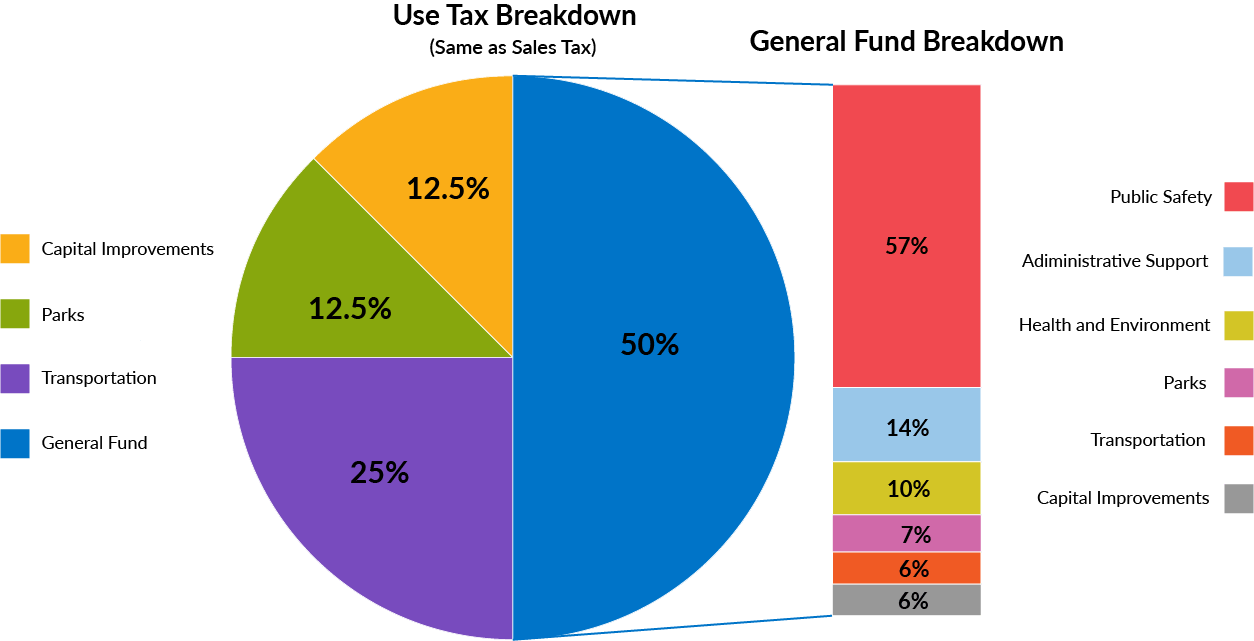

How does the Springfield sales tax compare to the rest of MO. The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent Conservation 0125 percent Education 10 percent and ParksSoils 010 percent. Police Fire or EMS dispatch.

State Use Tax - collected on vehiclesitems purchased outside the State of Illinois. For metropolitan and nonmetropolitan area definitions used by the OEWS survey see the metropolitan and nonmetropolitan area definitions page. Statewide salesuse tax rates for the period beginning November 2020.

Print a Back-to-School Sales Tax Holiday Rate Card If you do not know the tax rate for your locations access the rate tables above For questions regarding the Back-to-School Sales Tax Holiday email. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

840 Boonville Avenue Springfield MO 65802 Phone. Actual rates are often much higher in some areas reaching 10350. What is the sales tax rate in Springfield Missouri.

The base sales tax rate is 81. 112020 - 122020 - XLS. Missouri has 1090 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

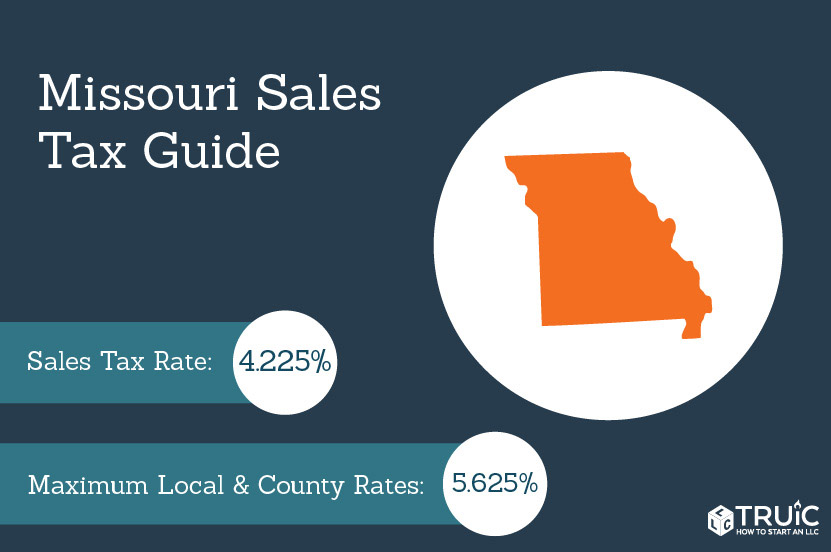

Single-family home is a 3 bed 20 bath property. Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. 2022 List of Missouri Local Sales Tax Rates.

The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. Statewide salesuse tax rates for the period beginning February 2020. Subtract these values if any from the sale.

The Missouri sales tax rate is currently. Tax Holiday Rate Tables - 080522 - 080722 - XLS. 01092020 TA0300 Display Only Changes.

The December 2020 total local sales tax rate was also 8600. State Sales Tax - imposed on a sellers receipts from sales of tangible personal property for use or consumption at the rate of 625 The City receives 16 of the 625.

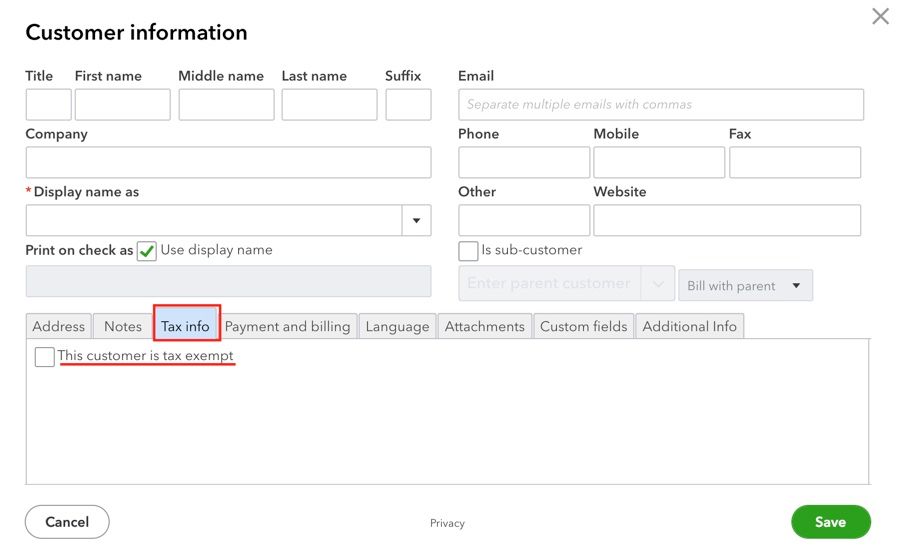

Setting Up Sales Tax In Quickbooks Online

Taxes Springfield Regional Economic Partnership

Use Tax Web Page City Of Columbia Missouri

Financial Reports Springfield Mo Official Website

Missouri Car Sales Tax Calculator

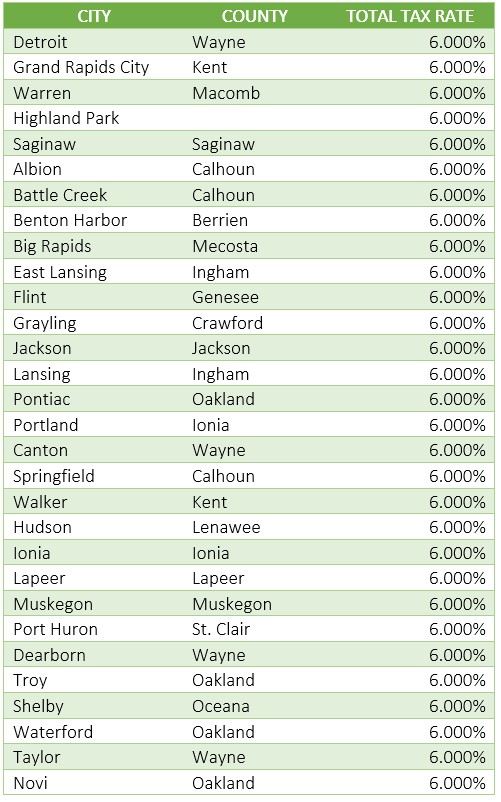

Michigan Sales Tax Guide For Businesses

Sales Tax On Grocery Items Taxjar

Missouri Sales Tax Small Business Guide Truic

Missouri Income Tax Rate And Brackets H R Block

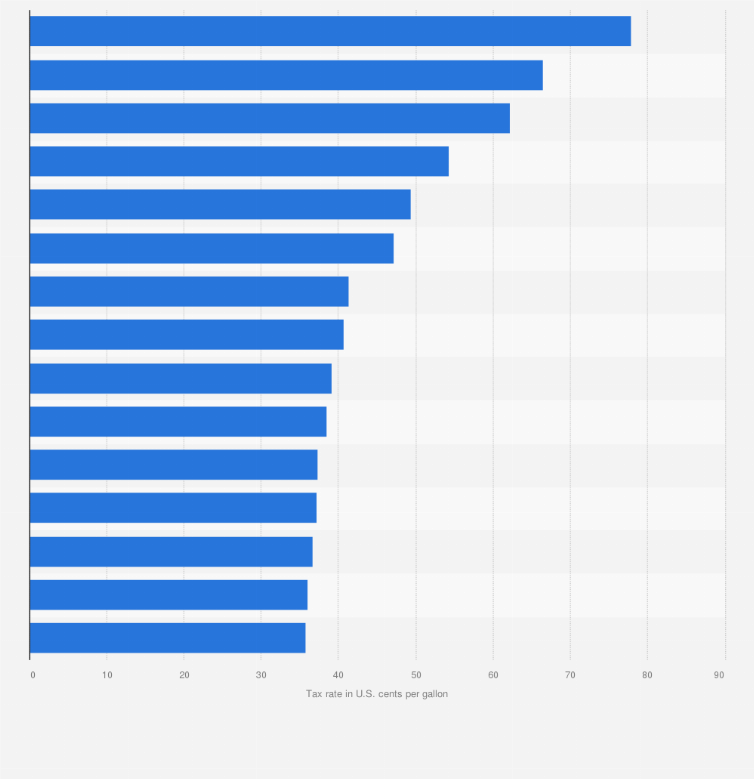

Highest Gas Tax In The U S By State 2022 Statista

Missouri Sales Tax Rates By City County 2022

/cloudfront-us-east-1.images.arcpublishing.com/gray/52PQVHDQV5AADCIUFDSB2QMP4Q.jpg)

Hickory County Looking To Impose A 911 Sales Tax Causes Confusion With Residents